Mortgage License Accelerator Capability

8 to 10 weeks deployment

- Accelerator provides a single intuitive platform to allow for easy tracking and managing of a Rep’s licensing process.

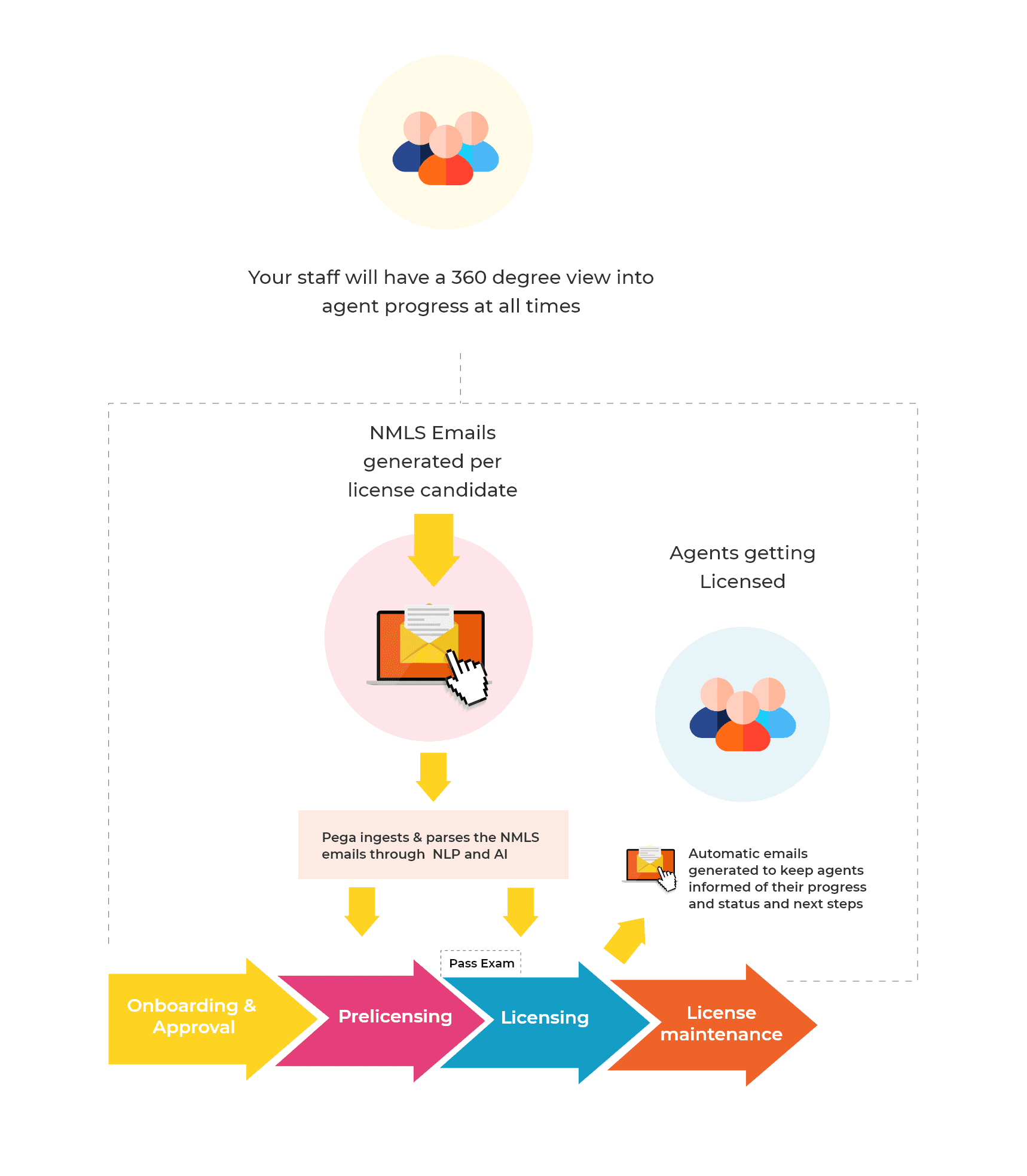

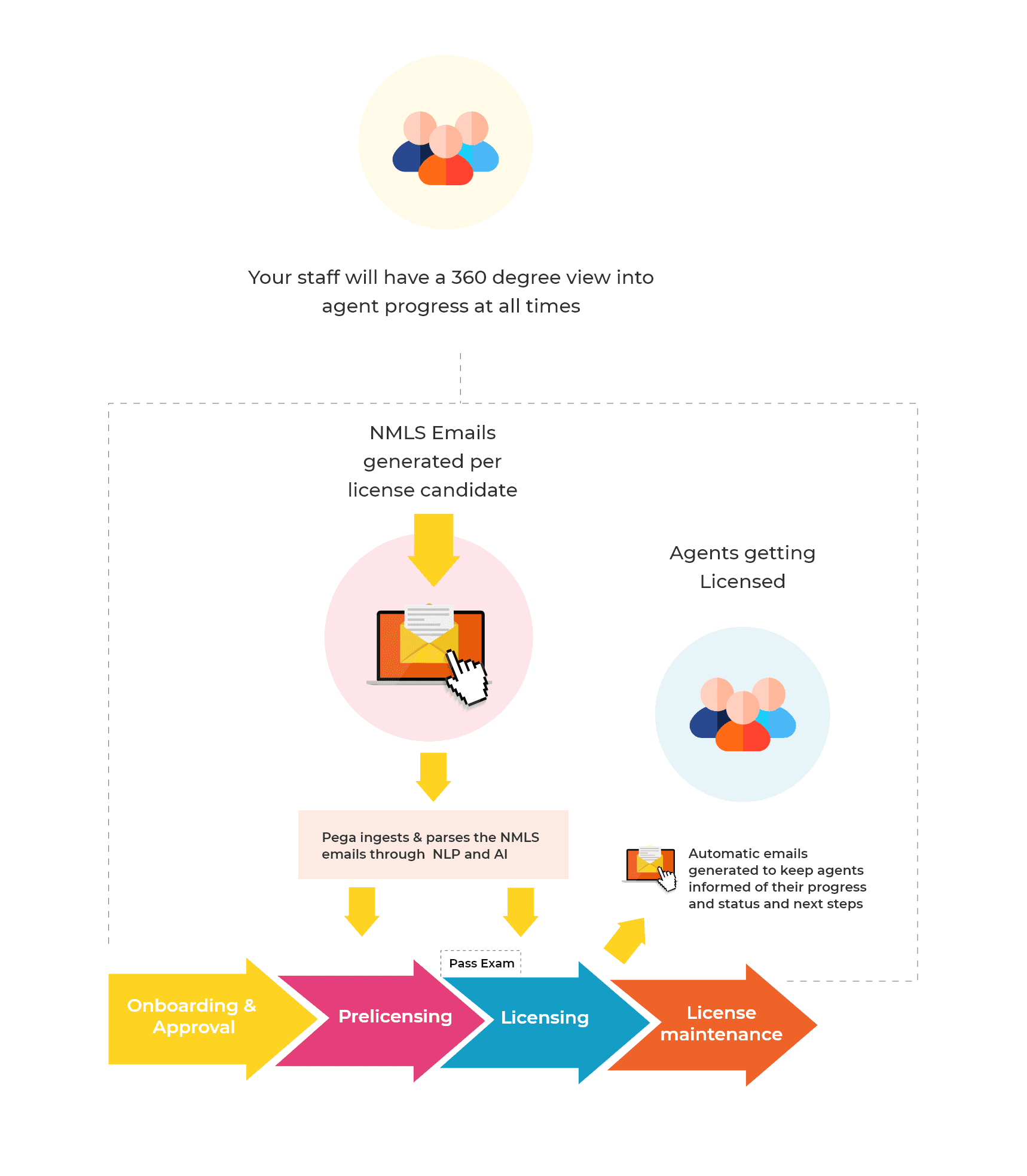

- Leverage PEGA’s NLP capabilities to process and ingest emails from NMLS resulting in real time automated updates that can advance the case in the workflow and creating timely next tasks(i.e Class Completion, Exam Score availability, identifying and closing deficiencies, accepting sponsorships and license approvals)

- Content Manager support for storing all documents associated with the case including emails received from NMLS and emails sent to candidates.

- Rule delegation to business manager group that allows for immediate changes in configuration for cost of the class, Exam cost and state-specific information

- Dashboards view to show open tasks, completed tasks and allow for workload management. Dedicated workpools that enables a structured view of outstanding steps for different Reps in the mortgage licensing process

- Consistent email communication with the Rep through the entire life cycle informing them on the next steps and updates

- Easy bulk upload for Rep’s training status that enable case transition

- Single state licensing to start with future potential to add additional states, license maintenance and enhanced Branch Management

Mortgage License Accelerator Flow

Business & Customer Outcomes

Accurate Real Time Reporting

20-30% efficiency gain within three to six months of usage through automated case creation and work routing

Improved compliance with state regulations

Significantly increased visibility as to where Reps are in process

Accurate Real Time Reporting

20-30% efficiency gain within three to six months of usage through automated case creation and work routing

Improved compliance with state regulations

Significantly increased visibility as to where Reps are in process

Ingestion of NMLS emails and directly linking information to cases for candidates in the license process

Consistent messaging and follow-up with Reps (automated emails)

All data related to mortgage stored in system of record tables via integration with company APIs to be used by other downstream systems and reporting

Ingestion of NMLS emails and directly linking information to cases for candidates in the license process

Consistent messaging and follow-up with Reps (automated emails)

All data related to mortgage stored in system of record tables via integration with company APIs to be used by other downstream systems and reporting